ovovis is a small software and consulting company that is active in the energy trading industry for more than 10 years. Managing director and co-founder is Thomas Enge.

We combine profound expertise in energy trading systems, optimisation and mathematical programming that we deliver to utilities and trading entities in Europe and UK.

Currently we are mainly engaged in Eastern Europe and Germany. We have a strong operational focus i.e. we join our clients in running their daily routines,

but also push their business forward by implementing custom tools and automated workflows. We are also active in developing decision support systems and risk management platforms for traders,

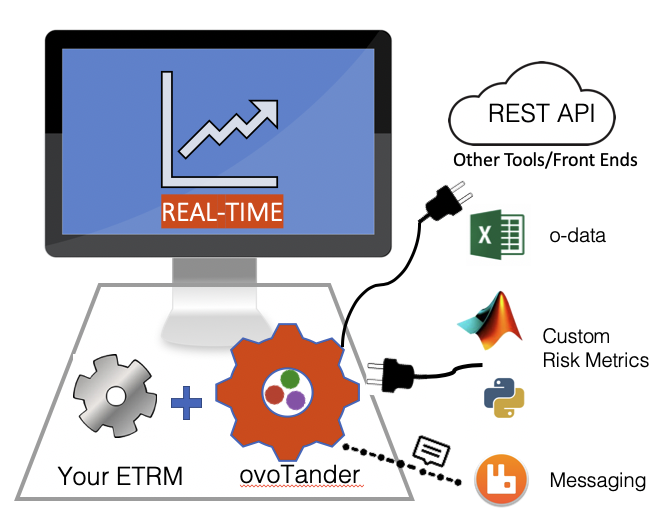

for instance ovoCredit and ovoSchedule, our former platforms that assisted traders to mitigate their credit and market risk in power markets. Currently we work on ovoTander,

our numeric engine for real-time position management and what-if analysis for energy traders that integrates with energy trading systems at ease and in a second step will interact with our

platforms.

ovovis is a small software and consulting company that is active in the energy trading industry for more than 10 years. Managing director and co-founder is Thomas Enge.

We combine profound expertise in energy trading systems, optimisation and mathematical programming that we deliver to utilities and trading entities in Europe and UK.

Currently we are mainly engaged in Eastern Europe and Germany. We have a strong operational focus i.e. we join our clients in running their daily routines,

but also push their business forward by implementing custom tools and automated workflows. We are also active in developing decision support systems and risk management platforms for traders,

for instance ovoCredit and ovoSchedule, our former platforms that assisted traders to mitigate their credit and market risk in power markets. Currently we work on ovoTander,

our numeric engine for real-time position management and what-if analysis for energy traders that integrates with energy trading systems at ease and in a second step will interact with our

platforms.

Tandem solution for your ETRM

ovoTander is a numeric engine that acts like a plug-in to your energy trading and risk managemt system (ETRM) enabling real-time position handling, what-if analysis and integration of custom pricing models for complex trades via an open API.

Built-in market expertise: Our architecture follows the rule "convention before configuration". Our large library of deal types allows for a high level of standardisation and aggregation and leads to an efficient calculation scheme.

What-If Analysis and Decision Support: Traders can quickly assess the impact of trade modifications and market price movements while ovoTander will assist with appropriate hedging strategies.

Close Integration: ovoTander does not require a deal migration or daily deal exports of any kind. Instead ovoTander links directly to your trading database and only labels your deals with our internal instruments that we use for valuation. This plug-in approach guarantees fast response times on the complete data set including latest updates and keeps the installation effort small.

Open interface: Instead of a separate GUI ovoTander implements the odata REST-API that seamlessly integrates with Excel, PowerBI, Tableau and SAP. As such traders can easily extend their existing spreadsheets. ovoTander also provides an API to its numeric engine allowing the integration of custom pricing models for more complex trades.